4 Ways To Help Your Teen Save Money

Help your teen save money with these teenager money management tips. Money management is an important life skill for teenagers. These tips will help you stay organised, set expectations, financial goals and help your teen become confident with their savings.

Save Some, Spend Some

Help your teen save money by sitting down and discussing a “Savings & spendings Agreement”. Each time your teen earns money, split it into the agreed ratio and teach them to save before they spend.

An Example: Your Teen earns $15 from doing odd jobs in the neighborhood on the weekend. If the agreement is to save 1/3 of all earning, $5 needs to be handed over for a long-term savings account.

Another option is a savings account that you can lock and comes with the ability to create savings goals and track spending easily. This way you can independently manage your money as a teenager with the option of asking a parent to lock the account.

If you live in Australia, Spriggy has a bank account option that comes with a fantastic app. The app allows savings to be segregated without needed a seperate bank account. Job lists and other goals can also be set off and marked off when finished.

Teach Your Teen The Value Of Shopping Around

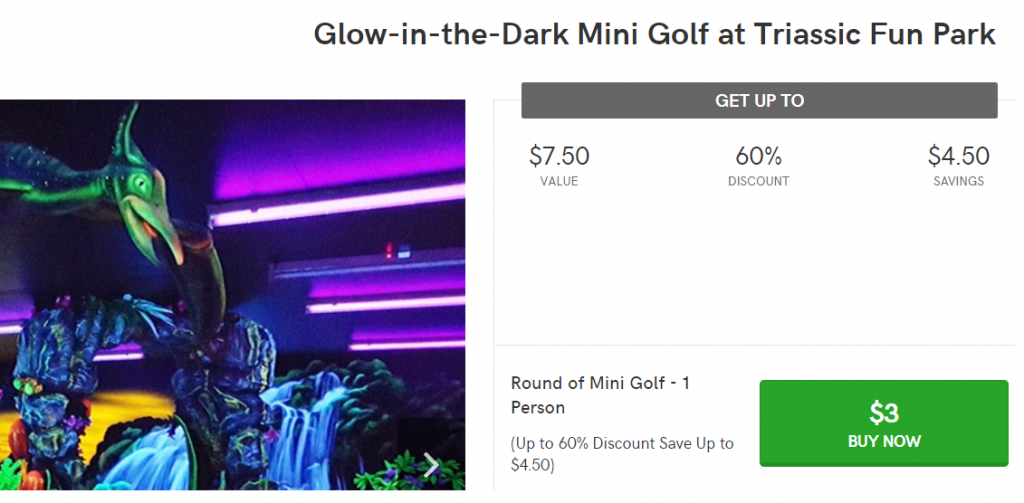

Help your teen save money by teaching them to use websites which offer major discounts and sales. Here is a list of websites that offer discounts in Australia.

Teach your teen to do a price comparison before buying items, especially expensive goods.

An Example: Your teen wants to go bowling on the weekend. Help your teen save money by instructing them to check all discount sites for local Bowling deals. If there are none, consider another activity on offer like laser skirmish.

Discount sites often offer up to 60% off family activities!

This will also help teach your child money management as they will need to keep track of their spendings while having the responsibility of online purchases.

Kick FOMO In The Butt

Fear Of Missing Out. It’s a habit we develop early which can go on to haunt us as adults. The idea that we need the latest model or have to go to an event the day it opens.

Sit down and discuss options with your teen, help them save money.

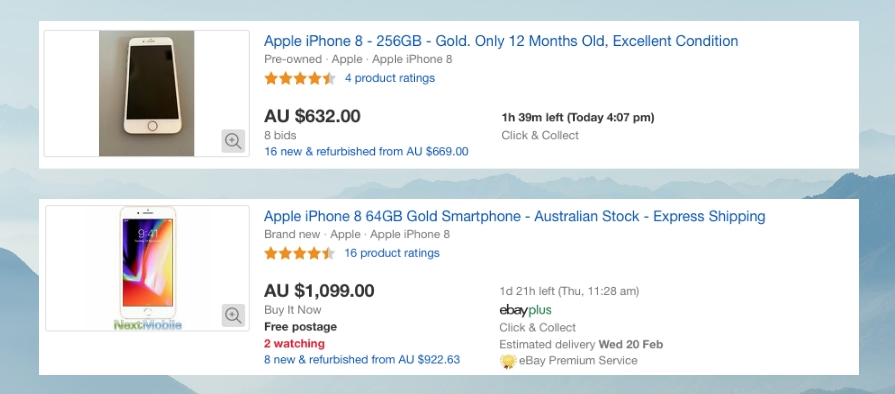

If you lay options out for them so they can understand the real cost of FOMO, most of the time they will make the right decision. An Example: Your teen has saved $500 over 12 months and wants to spend it on a brand new iPhone 5c.

Show your teen the options and the marketplace. Explain to them in order to save hundreds of dollars, they may have to accept waiting, buy a cheaper model or purchase secondhand.

Buying a retail product like an iPhone in-store comes with a top-dollar price tag. Your teen may save over $150 buying a refurbished product with a warranty.

Even better, opt for a second-hand device and pocket the $200 saving for something else.

Lay the options out for them, they will remember these discussions when they reach adulthood.

Teach Your Teen The Resale Value Of Products

Help your teen save money by teaching them the resale value of products.

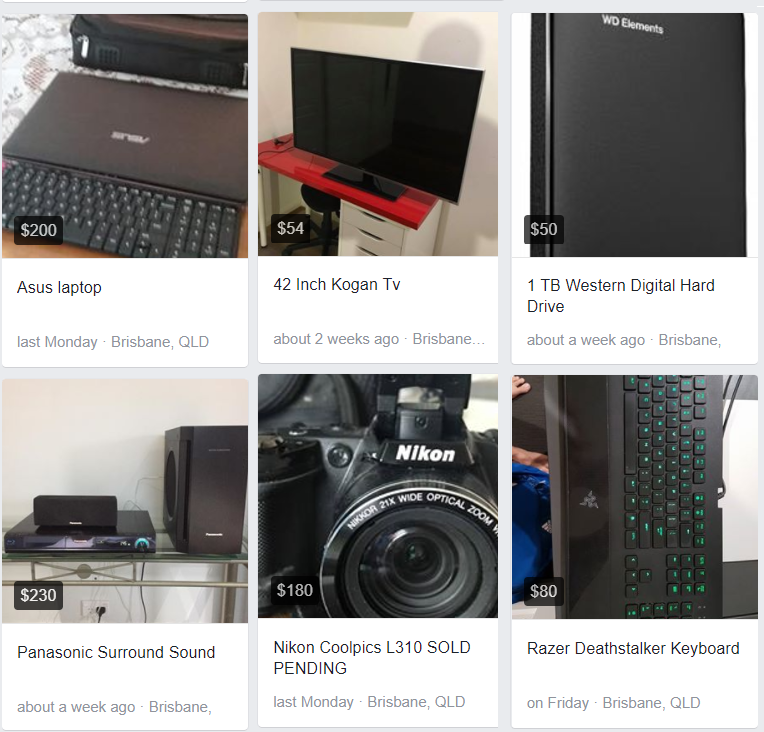

If you look on Ebay or the local Facebook Marketplace you will see the resale price for items your teen might own, but doesn’t use anymore. A great example is tech and games, sell them on Facebook.

An Example: When the Playstation 4 came out secondhand PS3 games were still selling for $10 per title, sometimes more.

Teach your child about planned obsolescence and sell the games they do not play anymore before the value drops. I’m willing to bet most teens can raise $100 cash within 7 days by simply going through their old tech, game, and DVD titles.

Helping your teen manage money will help them become financially savvy in their adult years.